- Smart Money investors have made significant profits from AVAX and are still holding their positions, which continues to impact retail sentiment.

- Market participants have begun offloading their assets, yet the price chart shows a clear path for a potential rally.

Avalanche [AVAX] recorded a 2.62% gain in the past 24 hours—its first positive performance after a month-long decline of 26.22%.

Analysis shows that these gains come as Smart Money investors reap massive profits from early bets on AVAX. However, the key question remains: will this spark renewed confidence or trigger a sell-off?

Smart money profits but holds AVAX

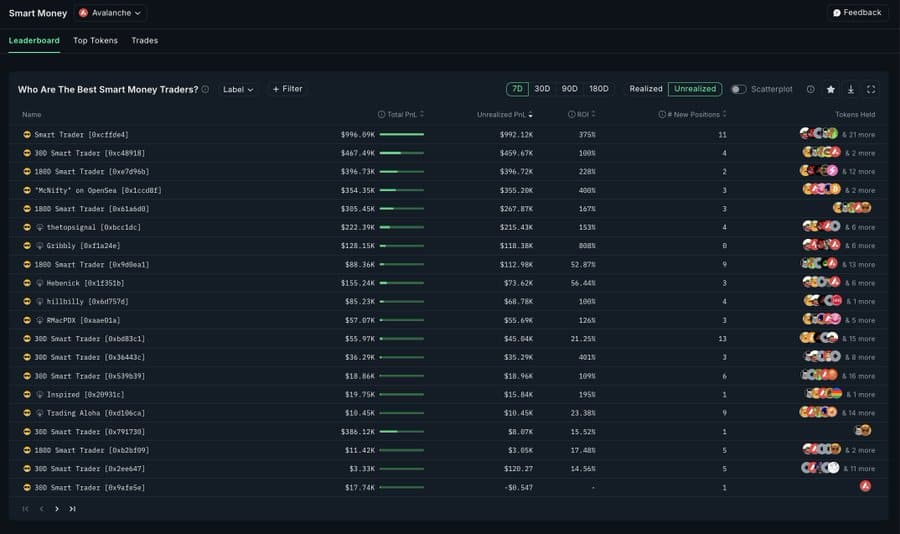

Insights from Nansen revealed that smart money investors in AVAX have made significant profits, despite a 13% overall decline in price.

For context, Smart Money refers to investors known for making profitable bets, buying low, and selling high.

Reports indicate these investors have earned profits of up to 375% during this period, with unrealized gains nearing $1 million across 11 positions.

With such substantial returns, these investors are typically expected to offload their holdings and cash out.

However, at press time, they continue to hold their positions. In contrast, retail investors are taking a different approach, selling their assets.

Retail data signals bearish bias

According to CoinGlass, retail investors have started cashing out, capitalizing on recent price gains.

At the time of writing, spot retail investors have reversed their buying behavior from the previous week—when they accumulated $11.9 million worth of AVAX—and have now started selling.

In the past 24 hours alone, these investors have sold $821,000 worth of AVAX, putting downward pressure on the price.

Similarly, derivative retail traders have begun opening short positions, betting on a further decline in AVAX’s price.

This trend was confirmed using the Open Interest Weighted Funding Rate—a metric used to analyze sentiment in the derivatives market, indicating whether traders are buying or selling.

As of now, this metric has dipped into negative territory, posting a reading of -0.0022% after remaining positive in previous days.

The bearish stance from both spot and derivative retail investors highlights the prevailing negative sentiment in the AVAX market.

AVAX chart signals breakout, but resistance levels remain

On the chart, AVAX showed a bullish path as it broke out of the resistance level in the descending channel pattern.

Typically, a breakout like this could lead the price to revisit the peak of the channel it emerged from, offering significant gains for traders.

However, rising selling pressure could make this move increasingly difficult. Moreover, key resistance levels lie ahead.

If the price manages to break the first resistance, it could signal that the bullish trend remains intact.

Still, another major hurdle stands at $19.81. Surpassing this level could propel the price to the $22 range, representing a 27% gain from the initial breakout point.

Market shows neutral sentiment

At press time, the Total Value Locked (TVL) has stayed stagnant, showing no significant inflows or outflows in the last 24 hours.

Current market behavior reflects investor indecision, which could weigh on AVAX’s overall momentum.

As broader sentiment shifts negative, AVAX may face a potential pullback, challenging the strength of its recent upward move.

- Smart Money investors have made significant profits from AVAX and are still holding their positions, which continues to impact retail sentiment.

- Market participants have begun offloading their assets, yet the price chart shows a clear path for a potential rally.

Avalanche [AVAX] recorded a 2.62% gain in the past 24 hours—its first positive performance after a month-long decline of 26.22%.

Analysis shows that these gains come as Smart Money investors reap massive profits from early bets on AVAX. However, the key question remains: will this spark renewed confidence or trigger a sell-off?

Smart money profits but holds AVAX

Insights from Nansen revealed that smart money investors in AVAX have made significant profits, despite a 13% overall decline in price.

For context, Smart Money refers to investors known for making profitable bets, buying low, and selling high.

Reports indicate these investors have earned profits of up to 375% during this period, with unrealized gains nearing $1 million across 11 positions.

With such substantial returns, these investors are typically expected to offload their holdings and cash out.

However, at press time, they continue to hold their positions. In contrast, retail investors are taking a different approach, selling their assets.

Retail data signals bearish bias

According to CoinGlass, retail investors have started cashing out, capitalizing on recent price gains.

At the time of writing, spot retail investors have reversed their buying behavior from the previous week—when they accumulated $11.9 million worth of AVAX—and have now started selling.

In the past 24 hours alone, these investors have sold $821,000 worth of AVAX, putting downward pressure on the price.

Similarly, derivative retail traders have begun opening short positions, betting on a further decline in AVAX’s price.

This trend was confirmed using the Open Interest Weighted Funding Rate—a metric used to analyze sentiment in the derivatives market, indicating whether traders are buying or selling.

As of now, this metric has dipped into negative territory, posting a reading of -0.0022% after remaining positive in previous days.

The bearish stance from both spot and derivative retail investors highlights the prevailing negative sentiment in the AVAX market.

AVAX chart signals breakout, but resistance levels remain

On the chart, AVAX showed a bullish path as it broke out of the resistance level in the descending channel pattern.

Typically, a breakout like this could lead the price to revisit the peak of the channel it emerged from, offering significant gains for traders.

However, rising selling pressure could make this move increasingly difficult. Moreover, key resistance levels lie ahead.

If the price manages to break the first resistance, it could signal that the bullish trend remains intact.

Still, another major hurdle stands at $19.81. Surpassing this level could propel the price to the $22 range, representing a 27% gain from the initial breakout point.

Market shows neutral sentiment

At press time, the Total Value Locked (TVL) has stayed stagnant, showing no significant inflows or outflows in the last 24 hours.

Current market behavior reflects investor indecision, which could weigh on AVAX’s overall momentum.

As broader sentiment shifts negative, AVAX may face a potential pullback, challenging the strength of its recent upward move.