Bitcoin has been attempting to break above the critical $109,000 level since last week but continues to face stiff resistance. Despite multiple intraday pushes, bulls have been unable to secure a decisive close above this key zone, keeping the market in a state of suspense. While BTC remains firmly above the psychological $100,000 mark, the longer it fails to reclaim $109K and move into price discovery, the greater the risk that bullish momentum could start to fade.

For now, buyers are still holding strong, defending support levels and keeping the uptrend structure intact. However, without a confirmed breakout, traders are becoming increasingly cautious. A clean move into new all-time highs would likely trigger renewed capital inflows and broader market confidence, but until that happens, Bitcoin remains at a crossroads.

Supporting this uncertain outlook is fresh data from CryptoQuant, which shows that BTC is currently trading just above its annual Realized Price ratio level. This suggests that Bitcoin is neither significantly overbought nor oversold, placing the market in a neutral zone. Historically, such positioning has often preceded major directional moves, making the coming days critical in determining whether BTC breaks higher or loses momentum.

Bitcoin Metrics Signal Market Neutrality

Bitcoin has been in a consolidation phase since early May, maintaining a firm position above the $100,000 level despite several attempts by bears to break it. The only significant dip below this psychological threshold occurred on June 22, and even then, BTC quickly recovered within hours. This resilience highlights the strength of buyer interest at six-figure levels. However, while bulls have successfully defended support, they’ve been unable to push past the critical $110,000 resistance, leading to growing speculation that a correction may be looming.

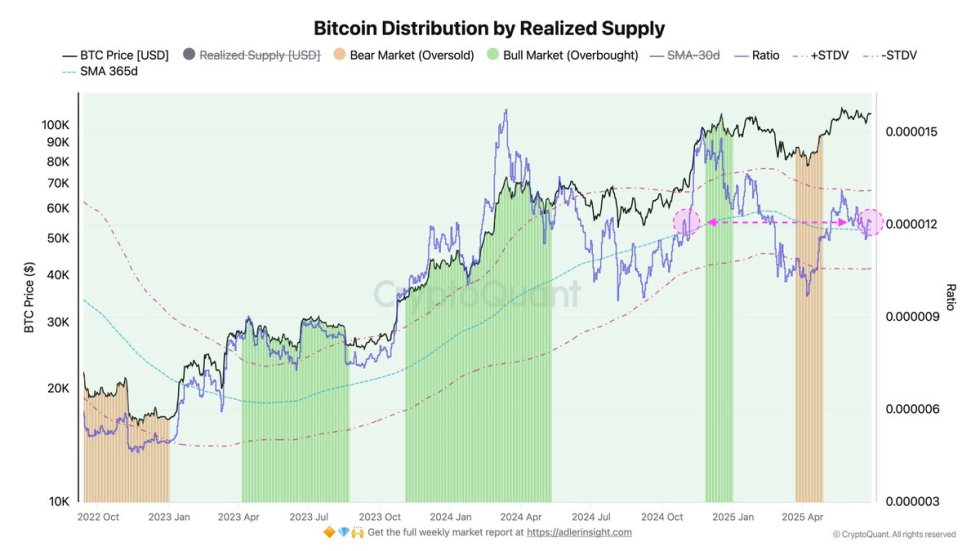

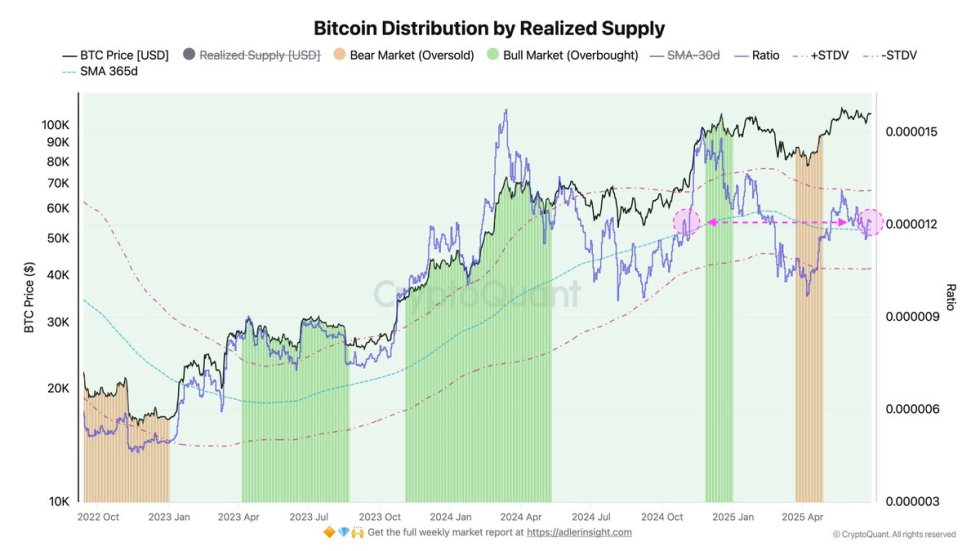

Adding valuable context to this uncertainty, top analyst Axel Adler shared insights into the Bitcoin Distribution by Realized Supply metric—a tool used to assess how expensive BTC is relative to what investors actually paid for it. Realized Supply calculates the total dollar value of all Bitcoin based on the prices at which coins last moved, offering a more grounded view of valuation.

The metric’s ratio, defined as BTC Price / Realized Supply, functions similarly to the P/E ratio in equities. A high ratio can suggest overvaluation, while a low one implies potential undervaluation. Currently, Bitcoin’s price is just slightly above the annual ratio level, putting it in a neutral valuation zone. Interestingly, this is the same setup seen in November 2024, right before BTC surged from $74K to $107K.

This suggests the market is neither overheated nor undervalued, positioning Bitcoin in a balanced zone where major moves could develop in either direction. As long as BTC remains in this range without a clear breakout or breakdown, traders should stay alert—this phase could be the calm before the next big shift.

BTC Faces Rejection At $109K As Price Consolidates

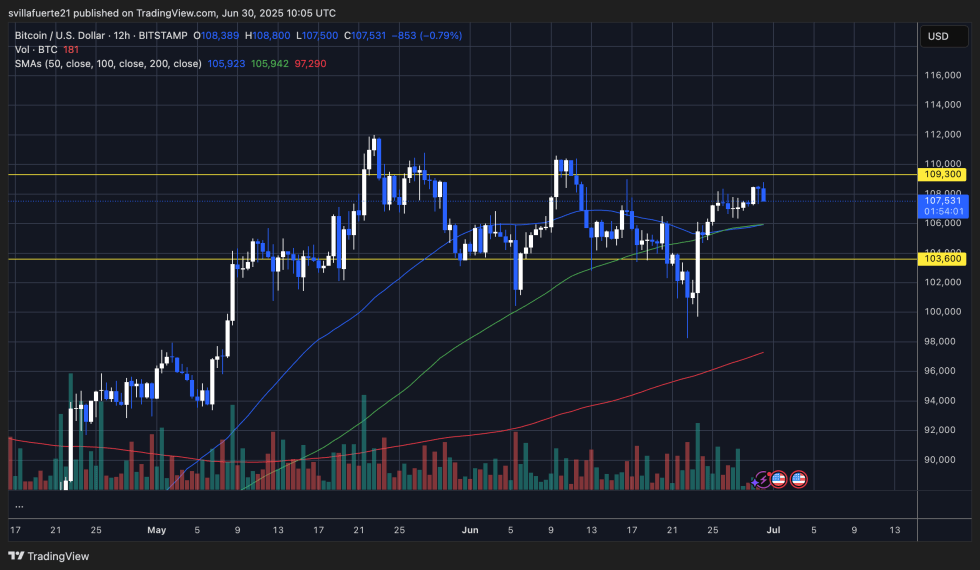

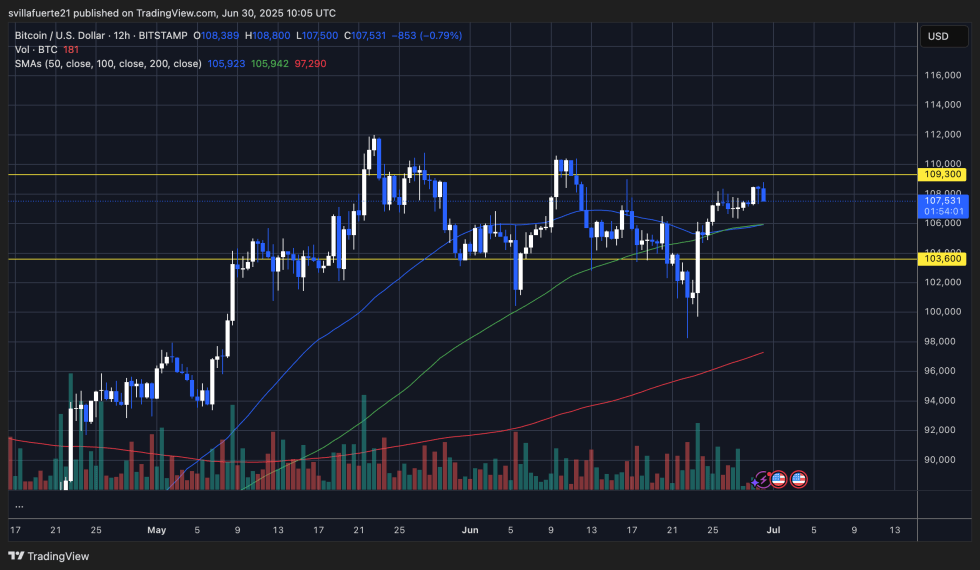

Bitcoin is currently trading at $107,531 on the 12-hour chart, showing signs of consolidation just below the critical resistance zone at $109,300. This level has acted as a ceiling for over a month, with multiple failed breakout attempts. The latest rejection from this level reflects the ongoing struggle between bulls and bears, as neither side has been able to confirm a decisive move.

Despite the rejection, the overall structure remains bullish. BTC continues to hold above all key moving averages—50 SMA ($105,923), 100 SMA ($105,942), and 200 SMA ($97,290)—with the 50 and 100 SMAs converging as dynamic support around the $106K level. This alignment favors bullish continuation if buyers can maintain pressure.

Volume has yet to show a convincing surge, indicating that traders are still waiting for confirmation before fully committing to new positions. A strong candle close above $109,300 would likely trigger upside momentum and shift BTC into price discovery. On the flip side, a drop below $105,000 would put the $103,600 support at risk and open the door to a broader pullback.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin has been attempting to break above the critical $109,000 level since last week but continues to face stiff resistance. Despite multiple intraday pushes, bulls have been unable to secure a decisive close above this key zone, keeping the market in a state of suspense. While BTC remains firmly above the psychological $100,000 mark, the longer it fails to reclaim $109K and move into price discovery, the greater the risk that bullish momentum could start to fade.

For now, buyers are still holding strong, defending support levels and keeping the uptrend structure intact. However, without a confirmed breakout, traders are becoming increasingly cautious. A clean move into new all-time highs would likely trigger renewed capital inflows and broader market confidence, but until that happens, Bitcoin remains at a crossroads.

Supporting this uncertain outlook is fresh data from CryptoQuant, which shows that BTC is currently trading just above its annual Realized Price ratio level. This suggests that Bitcoin is neither significantly overbought nor oversold, placing the market in a neutral zone. Historically, such positioning has often preceded major directional moves, making the coming days critical in determining whether BTC breaks higher or loses momentum.

Bitcoin Metrics Signal Market Neutrality

Bitcoin has been in a consolidation phase since early May, maintaining a firm position above the $100,000 level despite several attempts by bears to break it. The only significant dip below this psychological threshold occurred on June 22, and even then, BTC quickly recovered within hours. This resilience highlights the strength of buyer interest at six-figure levels. However, while bulls have successfully defended support, they’ve been unable to push past the critical $110,000 resistance, leading to growing speculation that a correction may be looming.

Adding valuable context to this uncertainty, top analyst Axel Adler shared insights into the Bitcoin Distribution by Realized Supply metric—a tool used to assess how expensive BTC is relative to what investors actually paid for it. Realized Supply calculates the total dollar value of all Bitcoin based on the prices at which coins last moved, offering a more grounded view of valuation.

The metric’s ratio, defined as BTC Price / Realized Supply, functions similarly to the P/E ratio in equities. A high ratio can suggest overvaluation, while a low one implies potential undervaluation. Currently, Bitcoin’s price is just slightly above the annual ratio level, putting it in a neutral valuation zone. Interestingly, this is the same setup seen in November 2024, right before BTC surged from $74K to $107K.

This suggests the market is neither overheated nor undervalued, positioning Bitcoin in a balanced zone where major moves could develop in either direction. As long as BTC remains in this range without a clear breakout or breakdown, traders should stay alert—this phase could be the calm before the next big shift.

BTC Faces Rejection At $109K As Price Consolidates

Bitcoin is currently trading at $107,531 on the 12-hour chart, showing signs of consolidation just below the critical resistance zone at $109,300. This level has acted as a ceiling for over a month, with multiple failed breakout attempts. The latest rejection from this level reflects the ongoing struggle between bulls and bears, as neither side has been able to confirm a decisive move.

Despite the rejection, the overall structure remains bullish. BTC continues to hold above all key moving averages—50 SMA ($105,923), 100 SMA ($105,942), and 200 SMA ($97,290)—with the 50 and 100 SMAs converging as dynamic support around the $106K level. This alignment favors bullish continuation if buyers can maintain pressure.

Volume has yet to show a convincing surge, indicating that traders are still waiting for confirmation before fully committing to new positions. A strong candle close above $109,300 would likely trigger upside momentum and shift BTC into price discovery. On the flip side, a drop below $105,000 would put the $103,600 support at risk and open the door to a broader pullback.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.