Public companies are taking a more aggressive stance on Bitcoin (BTC) than even the much-celebrated exchange-traded funds (ETFs). For the third consecutive quarter, they acquired more BTC than ETFs in Q2 2025.

The trend signals a broader strategic shift among corporate treasuries to adopt Bitcoin as a balance sheet asset.

Corporate Treasuries Take the Lead in Bitcoin Accumulation

Barely a month ago, BeInCrypto reported that more than 60 companies are following MicroStrategy’s Bitcoin playbook, with the report coming ahead of the second quarter (Q2) closing.

Based on the latest findings, public companies continue to uphold the MicroStrategy playbook, progressively mainstreaming the strategy in a crypto-friendly US regulatory environment.

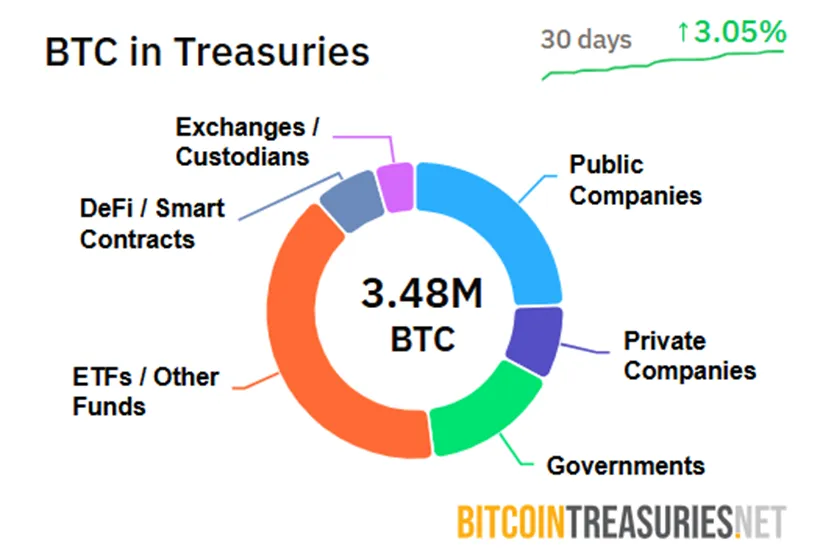

According to data on Bitcoin Treasuries, public companies increased their BTC holdings by roughly 18% in Q2, adding approximately 131,000 BTC.

Exchange-traded funds, by comparison, despite their popularity since the US Bitcoin ETF approval wave in January 2024, only expanded their holdings by 8%, or around 111,000 BTC, during the same period.

The trend marks a clear divergence in buyer behavior. While ETFs typically serve investors seeking price exposure to Bitcoin through regulated financial products, public companies acquire BTC with a longer-term strategic mindset.

They aim to increase shareholder value by holding BTC as a reserve asset or to gain exposure to what many view as digital gold.

This shift is particularly significant in the context of US policy. Since President Donald Trump’s re-election, the regulatory environment has shifted in favor of the crypto industry.

In March, Trump signed an executive order establishing a US Bitcoin reserve. This symbolic but powerful move eliminated much of the reputational risk associated with corporate BTC holdings.

The last time ETFs outpaced companies in BTC acquisition was in Q3 2024, before Trump’s return to office.

New Corporate Entrants Signal Broader Adoption of Bitcoin Treasury Strategy

This Q2 surge included some high-profile moves, including GameStop. The electronics company, once at the center of retail trading frenzies, began accumulating BTC after approving it as a treasury reserve asset in March.

Similarly, Healthcare firm KindlyMD merged with Nakamoto, a Bitcoin investment company founded by crypto advocate David Bailey.

Meanwhile, ProCap, Anthony Pompliano’s new investment vehicle, announced its own BTC accumulation strategy while preparing to go public via SPAC.

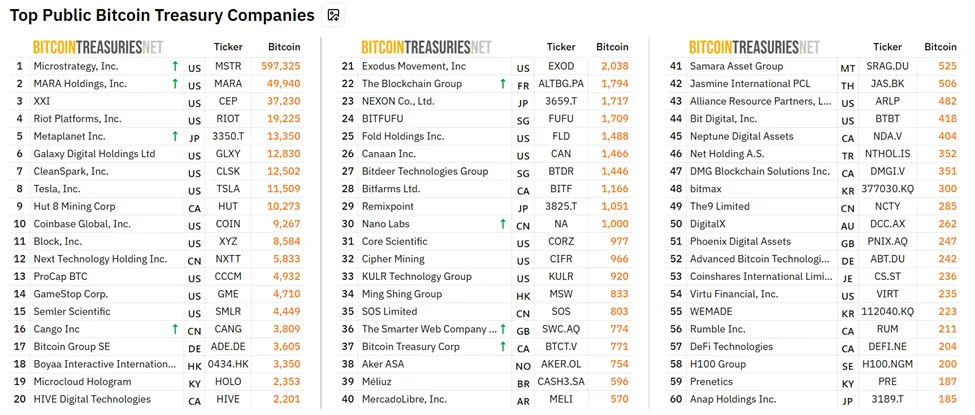

Nevertheless, Strategy (formerly MicroStrategy) remains the undisputed leader in the corporate Bitcoin race with 597,325 BTC under management. Mara Holdings follows, holding 49,940 coins.

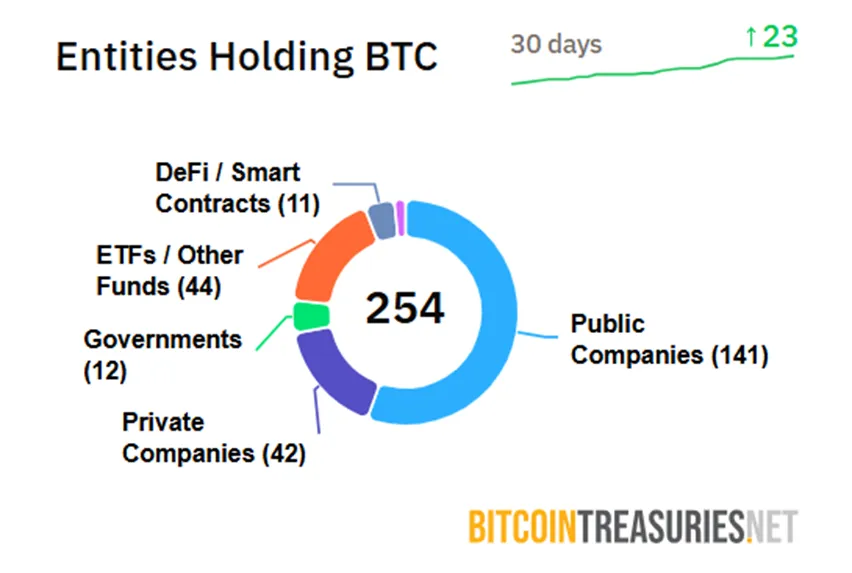

Combined, public companies now hold approximately 855,000 BTC, about 4% of Bitcoin’s fixed supply cap of 21 million.

ETFs still hold more in absolute terms (around 1.4 million BTC or 6.8%), but corporate buying momentum has been stronger in recent quarters.

While the long-term sustainability of the corporate Bitcoin rush is up for debate, the short-term momentum is unmistakable.

As Bitcoin becomes more normalized, traditional institutional investors may bypass proxies such as ETFs and treasuries, eventually gaining direct exposure through regulated channels. Still, corporate treasuries are acting as a powerful new mechanism for pushing Bitcoin forward.

With the regulatory climate aligned and equity markets offering new ways to access capital, companies are leveraging their balance sheets not just to hedge, but to outperform.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.