Following Strategy’s example, companies increasingly invest in Bitcoin, a trend bolstered by the cryptocurrency’s rising price. However, these massive acquisitions raise concerns over market collapse if companies are forced to sell and questions over Bitcoin’s decentralized ethos.

Representatives from Bitwise, Komodo Platform, and Sentora state that the benefits largely outweigh the risks. While small, overleveraged companies might go bankrupt, their market impact would be minimal. They foresee no imminent risks, as successful companies like MicroStrategy show no signs of liquidating assets.

The Growing Trend of Corporate Bitcoin Adoption

The number of companies joining the corporate Bitcoin acquisition trend is growing. While Standard Chartered recently reported that at least 61 publicly traded firms bought crypto, Bitcoin Treasuries reports that the number has reached 130.

As Strategy (formerly MicroStrategy) continues accumulating billions in unrealized gains from its aggressive Bitcoin acquisitions, bolstered by a rising Bitcoin price, more companies are likely to follow suit.

“The Wilshire 5000 equity index literally includes 5000 publicly listed companies in the US alone. It is quite likely that we are going to see a significant acceleration in the corporate treasury adoption of Bitcoins this year and in 2026 as well,” André Dragosch, Head of Research for Bitwise in Europe, told BeInCrypto.

The reasons fueling his belief are multi-fold.

How Does Bitcoin’s Volatility Compare to Other Assets?

While volatile, Bitcoin has historically demonstrated exceptionally high returns compared to traditional asset classes like stocks and gold.

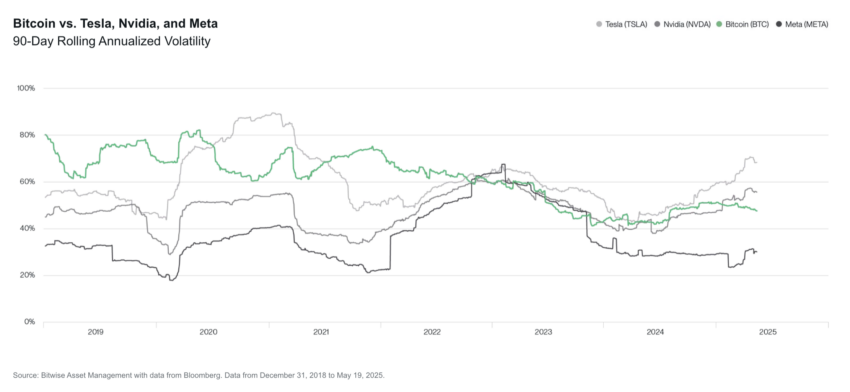

“One particularly interesting data point is the volatility of Bitcoin compared to leading tech stocks, such as Tesla and Nvidia. Many investors say, ‘I would never invest in something as volatile as Bitcoin,’ Ryan Rasmussen, Head of Research at Bitwise, explained, adding, “At the same time, most investors own Tesla and Nvidia (either directly or through index funds like the S&P 500 and Nasdaq-100). In recent months, Tesla and Nvidia have both been more volatile than Bitcoin.”

Though past performance does not guarantee future returns, Bitcoin’s current performance, which has been particularly stable, may motivate more companies to purchase the asset.

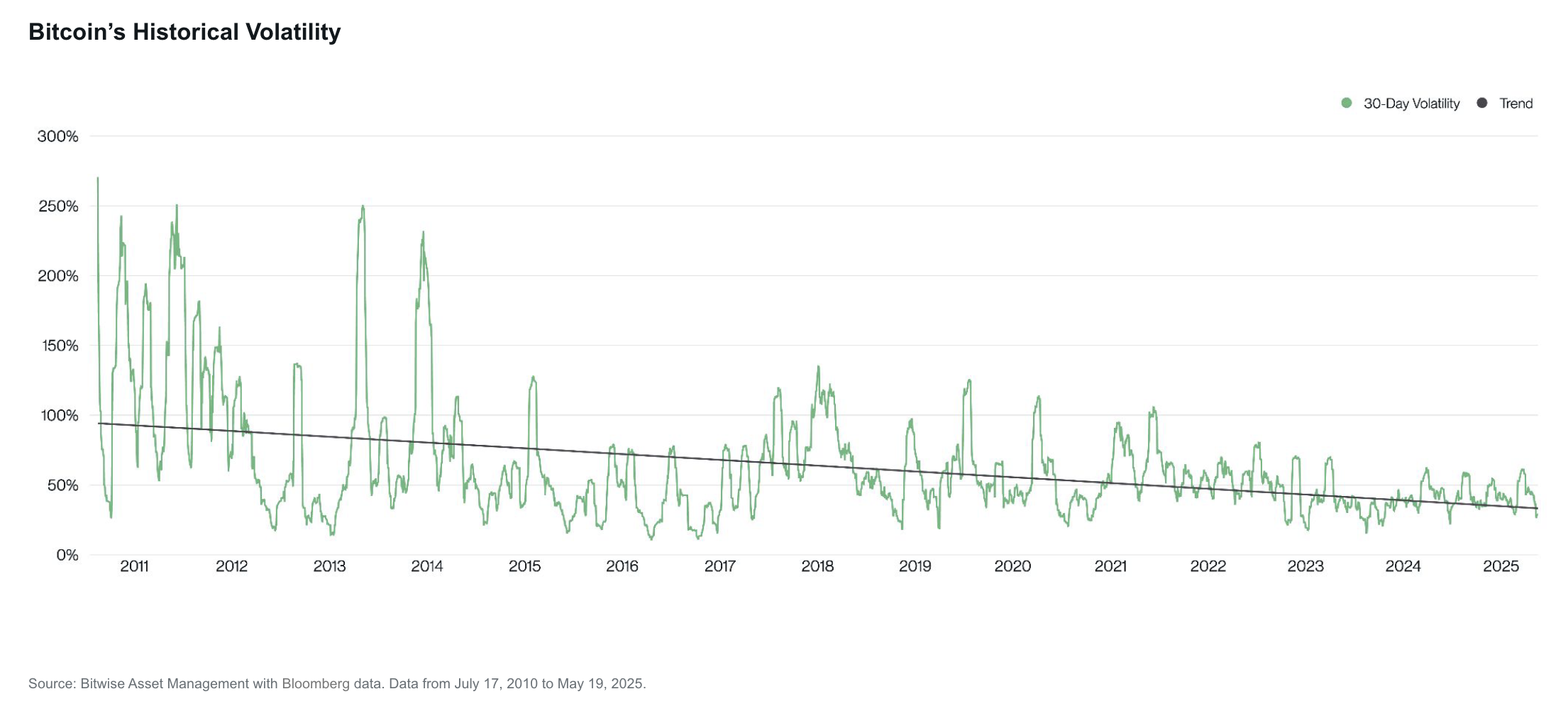

“Bitcoin’ s volatility has decreased over time—a trend that will be maintained for the foreseeable future. As Bitcoin discovers its true price, the volatility will shrink to near zero, and that is the point at which demand could slow. As long as there is volatility in Bitcoin, it could likely be increasing in price on a long-term time horizon, if the past is any indication,” Kadan Stadelmann, Chief Technology Officer at Komodo Platform, told BeInCrypto.

Meanwhile, as global markets grapple with economic challenges, Bitcoin could become an appealing option for improving weak financial balance sheets.

Will Bitcoin Outcompete Traditional Safe Havens?

The United States and the greater global economy have suffered geopolitical tensions, rising inflation rates, and worrisome fiscal deficits. Seen as “digital gold” and a sovereign-neutral store of value, Bitcoin has piqued the interest of different shareholders, especially after Strategy’s triumph.

“Pressure from existing shareholders will certainly increase over time as more companies adopt such a corporate policy, especially if inflation rates should start to re-accelerate on account of rising geopolitical risks and increasing fiscal debt monetization by central banks. Many companies are also operating in a saturated low-growth industry with high amounts of debt where an adoption of Bitcoin can certainly boost returns for existing shareholders,” Dragosch explained.

He predicted that the day Bitcoin outperformed traditional safe havens like US Treasury bills and gold would eventually come. As adoption surges, Bitcoin’s volatility will fall, making it an all-around competitive asset.

“Bitcoin’s volatility has been on a structural downtrend since the very beginning. The key reasons behind this structural decline are increasing scarcity due to the halvings and increasing adoption, which tends to dampen volatility. Our expectation is that Bitcoin’s volatility will ultimately converge towards gold’s volatility and become a prime contender for an alternative store-of-value and reserve asset,” he said.

Meanwhile, Bitcoin’s technological backdrop would also give it a competitive edge over other asset classes.

“Due to its technical superiority relative to gold, we think there is a high likelihood that Bitcoin could ultimately disrupt gold and other stores-of-value like US Treasury bonds over the long term. This will become increasingly relevant in [the] face of rising sovereign debt risks globally,” Dragosch added.

However, not all companies are created equal. While some stand to benefit, others don’t.

Differentiating Corporate Bitcoin Strategies

According to Rasmussen, there are two types of Bitcoin treasury companies.

They are either profitable businesses investing spare cash, like Coinbase or Square, or firms that secure debt or equity to buy Bitcoin. Regardless of the type, their accumulation boosts Bitcoin demand, pushing its price up in the short term.

Profitable businesses that buy Bitcoin using excess cash are uncommon and present no systemic risk. Rasmussen anticipates these companies will continue accumulating Bitcoin in the long term.

Firms that resort to debt or equity might face a different fate.

“Bitcoin financing companies only exist because public markets are willing to pay more than $1 for $1 of Bitcoin exposure. This is unsustainable long-term unless these companies can increase their Bitcoin per share. Issuing equity to buy Bitcoin does not increase Bitcoin per share. The only way to increase Bitcoin per share is to issue convertible debt or preferred stock,” Rasmussen explained.

The success rates of these companies depend on how much profit they have to pay back their debts.

Mitigating Corporate Bitcoin Risk

Larger, established companies always have more resources than smaller ones to manage their debt.

“The large and well-known Bitcoin treasury companies, such as Strategy, Metaplanet, and GameStop, should be able to refinance their debt or issue equity to raise cash to repay their debt with relative ease. The smaller and lesser-known companies that do not have profitable businesses are most at risk of having to sell Bitcoin to meet their obligations,” he added.

According to Dragosch, the key to avoiding such a scenario for smaller companies is to prevent overleveraging. In other words, borrow what you can afford to repay.

“They key element that often breaks any type of business strategy is overleverage… potential risks rather lie with other corporations that are copying MSTR’s Bitcoin acquisition strategy and start with a higher cost basis. This increases the risk of forced liquidations and bankruptcy in the next bear market, especially if these corporations accumulate too much debt in the process and overleverage,” he said.

However, these liquidations would have minimal market effects.

“That would create short-term volatility for Bitcoin and be detrimental to those companies’ share prices, but it’s not a blow-up risk to the broader crypto ecosystem. It’ll likely be a relatively small number of small companies that have to sell a relatively immaterial amount of Bitcoin to pay back their debt. If that’s the case, the market will hardly blink,” Rasmussen said.

The real problem emerges when larger players decide to sell off their holdings.

Are Large Holdings a Systemic Risk?

More companies adding Bitcoin to their balance sheets create decentralization, at least at the market level. Strategy is no longer the only corporation employing this strategy.

That said, Strategy’s holdings are enormous. Today, it owns nearly 600,000 Bitcoins– 3% of the total supply. This type of centralization does indeed come with liquidation risks.

“More than 10% of all Bitcoin is now held in ETF custodial wallets and corporate treasuries; a sizable share of the total supply. This concentration introduces a systemic risk: if any of these centrally managed wallets are compromised or mishandled, the fallout could ripple through the entire market,” Juan Pellicer, Vice President of Research at Sentora, told BeInCrypto.

Some experts believe such a scenario is unlikely. If it were to happen, Stadelmann predicts initial negative outcomes would eventually stabilize.

“If MicroStrategy were to sell a large portion of its Bitcoins, it will develop a plan to do so without affecting the market at first. Eventually, people will realize what is happening, and that will lead to a broader sell-off and depressed Bitcoin prices. However, the lower prices combined with Bitcoin’s limited supply of only 21 million coins will lead to demand for Bitcoin by different players, including other corporations and nation-states,” he said.

However, the significant amount of Bitcoin held by a few large corporations raises renewed concerns about the centralization of the asset itself rather than the competition.

Centralization as a Trade-Off for Adoption

Large corporate accumulation raises concerns about concentrated ownership of Bitcoin’s limited supply. This challenges a core DeFi principle and generates anxiety over the disruption of its foundational structure.

According to Dragosch, this isn’t the case. No one can change Bitcoin’s rules by owning most of the supply.

“The beauty about Bitcoin’s proof-of-work consensus algorithm is that you cannot change Bitcoin’s rules by owning the majority of the supply which is different to other cryptoassets like Ethereum. In the case of Bitcoin, a majority of hash rate is rather needed to change consensus rules or corrupt/attack the network. Institutions that invest into Bitcoin will need to play by Bitcoin’s protocol rules after all,” he said.

In turn, Pellicer does see some truth in these concerns. However, he views them as a trade-off for the other advantages of widespread adoption.

“While this centralization conflicts with Bitcoin’s ethos of individual, self-sovereign ownership, institutional custody might still be the most practical path to widespread adoption, providing the regulatory clarity, liquidity, and ease of use that many new participants expect,” he said.

With companies increasingly leveraging Bitcoin for strategic financial benefits, its path toward becoming a widely accepted reserve asset is accelerating. For now, the risk of a market collapse seems to be contained.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.