Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is currently facing a pivotal moment as it continues to consolidate below the $3,000 level. Bulls are targeting a breakout above this key resistance zone, which could trigger a major upward move. However, broader market conditions remain fragile. Geopolitical tensions—particularly the ongoing conflict between Israel and Iran—continue to create a high-risk macroeconomic environment, leading to increased volatility and intermittent selling pressure across risk assets.

Related Reading

Despite these challenges, ETH has shown resilience by holding above the $2,500 support zone. The price has remained locked in a narrow trading range for weeks, reflecting market indecision and caution among participants. According to a technical analysis shared by top analyst Daan, Ethereum continues to trade within this very tight range, with price wicks on both sides consistently getting absorbed. This type of price action signals growing compression, often a precursor to a strong directional move once one side gives in.

Traders are now closely monitoring the structure for a higher timeframe close above $2,800, which could validate bullish momentum and open the path toward $3,000 and beyond. Until then, the market appears balanced, and any shift in geopolitical developments may quickly tilt sentiment in either direction.

Ethereum Prepares For Breakout as Market Awaits Confirmation

Ethereum remains over 60% below its 2024 high of $4,100, but the asset is showing signs of recovery after months of downward pressure and indecision. Bulls have struggled to regain control throughout the year, but recent price action indicates the start of a potential rally. This recovery, however, remains tentative and will require confirmation through a higher timeframe close above critical resistance levels, particularly the $2,800–$3,000 range.

The broader environment continues to weigh heavily on sentiment. Escalating geopolitical tensions in the Middle East, coupled with macroeconomic uncertainty—including rising U.S. Treasury yields and concerns about inflation—are creating headwinds for risk assets, Ethereum included. Despite this, ETH has managed to hold key support above the $2,500 level, a sign that bulls are defending their ground.

According to technical analysis shared by analyst Daan, Ethereum is currently trading within a very tight range, with price wicks on both sides being consistently absorbed. This type of compression typically signals an incoming surge in volatility. Daan notes that once one side gives in, the resulting move often becomes explosive and sustained.

The current range-bound action reflects equilibrium between buyers and sellers, but that balance won’t last forever. Traders are watching closely for a decisive higher timeframe close above resistance—or below support—as confirmation of the next trend direction. With ETH positioned near major technical zones, a breakout could lead to significant momentum, potentially bringing Ethereum closer to reclaiming the psychological $3,000 mark and reigniting a push toward cycle highs. Until then, the market remains in a wait-and-see mode.

Related Reading

Ethereum Continues Range-Bound Trading As Key Support Holds

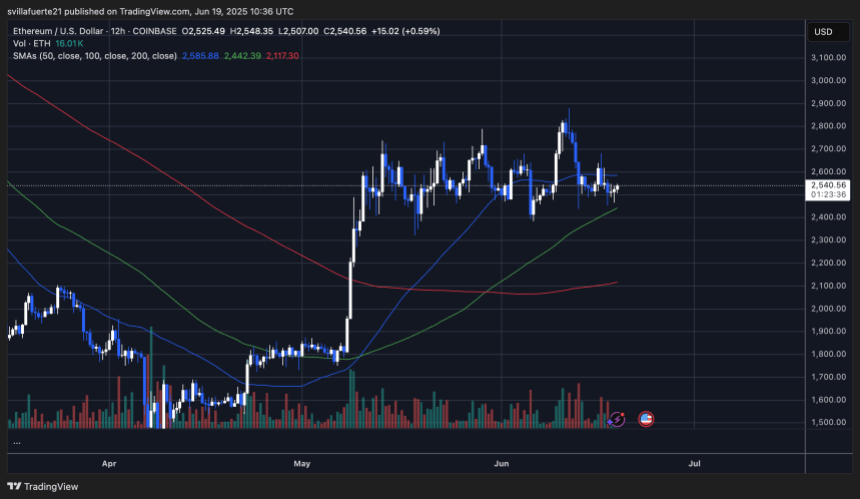

Ethereum (ETH) remains locked in a tight range between approximately $2,500 and $2,800, showing little directional clarity over the past several weeks. The chart above (12-hour timeframe) reflects persistent consolidation with multiple wicks on both ends of the candles, indicating absorption of both bullish and bearish momentum. This suggests that neither buyers nor sellers have taken firm control.

ETH currently trades near $2,540 and is holding above the 100-period simple moving average (SMA), which is acting as short-term support. The 50 SMA has flattened, further reinforcing the sideways nature of the price action. Volume has also tapered off, typical in compression phases that often precede strong breakouts or breakdowns.

If ETH fails to reclaim the $2,675–$2,800 resistance zone, the 200 SMA near $2,117 may become relevant as a deeper support target. However, as long as ETH maintains price action above $2,500, bulls are still in play.

Related Reading

The structure suggests that Ethereum is building energy for a decisive move. A higher timeframe close above $2,800 could trigger a new leg up toward $3,000 and beyond. Conversely, a break below $2,500 could lead to renewed bearish pressure. For now, traders are watching for breakout confirmation.

Featured image from Dall-E, chart from TradingView

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is currently facing a pivotal moment as it continues to consolidate below the $3,000 level. Bulls are targeting a breakout above this key resistance zone, which could trigger a major upward move. However, broader market conditions remain fragile. Geopolitical tensions—particularly the ongoing conflict between Israel and Iran—continue to create a high-risk macroeconomic environment, leading to increased volatility and intermittent selling pressure across risk assets.

Related Reading

Despite these challenges, ETH has shown resilience by holding above the $2,500 support zone. The price has remained locked in a narrow trading range for weeks, reflecting market indecision and caution among participants. According to a technical analysis shared by top analyst Daan, Ethereum continues to trade within this very tight range, with price wicks on both sides consistently getting absorbed. This type of price action signals growing compression, often a precursor to a strong directional move once one side gives in.

Traders are now closely monitoring the structure for a higher timeframe close above $2,800, which could validate bullish momentum and open the path toward $3,000 and beyond. Until then, the market appears balanced, and any shift in geopolitical developments may quickly tilt sentiment in either direction.

Ethereum Prepares For Breakout as Market Awaits Confirmation

Ethereum remains over 60% below its 2024 high of $4,100, but the asset is showing signs of recovery after months of downward pressure and indecision. Bulls have struggled to regain control throughout the year, but recent price action indicates the start of a potential rally. This recovery, however, remains tentative and will require confirmation through a higher timeframe close above critical resistance levels, particularly the $2,800–$3,000 range.

The broader environment continues to weigh heavily on sentiment. Escalating geopolitical tensions in the Middle East, coupled with macroeconomic uncertainty—including rising U.S. Treasury yields and concerns about inflation—are creating headwinds for risk assets, Ethereum included. Despite this, ETH has managed to hold key support above the $2,500 level, a sign that bulls are defending their ground.

According to technical analysis shared by analyst Daan, Ethereum is currently trading within a very tight range, with price wicks on both sides being consistently absorbed. This type of compression typically signals an incoming surge in volatility. Daan notes that once one side gives in, the resulting move often becomes explosive and sustained.

The current range-bound action reflects equilibrium between buyers and sellers, but that balance won’t last forever. Traders are watching closely for a decisive higher timeframe close above resistance—or below support—as confirmation of the next trend direction. With ETH positioned near major technical zones, a breakout could lead to significant momentum, potentially bringing Ethereum closer to reclaiming the psychological $3,000 mark and reigniting a push toward cycle highs. Until then, the market remains in a wait-and-see mode.

Related Reading

Ethereum Continues Range-Bound Trading As Key Support Holds

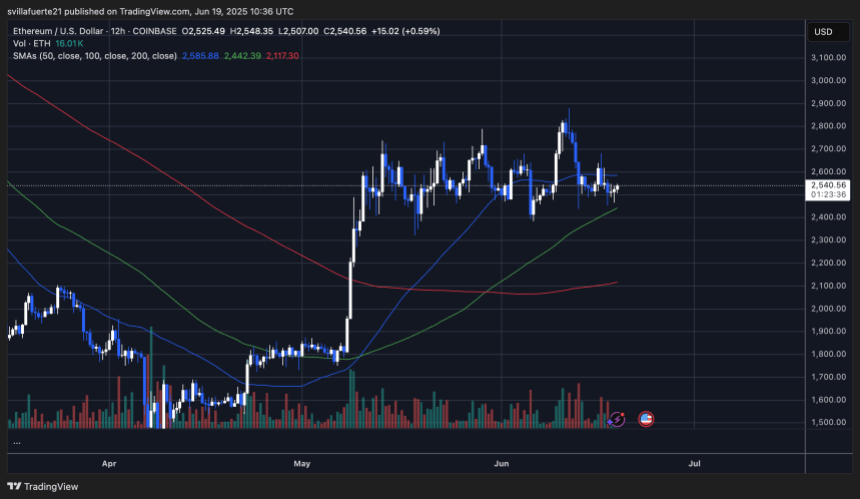

Ethereum (ETH) remains locked in a tight range between approximately $2,500 and $2,800, showing little directional clarity over the past several weeks. The chart above (12-hour timeframe) reflects persistent consolidation with multiple wicks on both ends of the candles, indicating absorption of both bullish and bearish momentum. This suggests that neither buyers nor sellers have taken firm control.

ETH currently trades near $2,540 and is holding above the 100-period simple moving average (SMA), which is acting as short-term support. The 50 SMA has flattened, further reinforcing the sideways nature of the price action. Volume has also tapered off, typical in compression phases that often precede strong breakouts or breakdowns.

If ETH fails to reclaim the $2,675–$2,800 resistance zone, the 200 SMA near $2,117 may become relevant as a deeper support target. However, as long as ETH maintains price action above $2,500, bulls are still in play.

Related Reading

The structure suggests that Ethereum is building energy for a decisive move. A higher timeframe close above $2,800 could trigger a new leg up toward $3,000 and beyond. Conversely, a break below $2,500 could lead to renewed bearish pressure. For now, traders are watching for breakout confirmation.

Featured image from Dall-E, chart from TradingView