- Multiple Solana whale addresses dumped over $46 million tokens in one day.

- the altcoin could dip further if broader sentiment remains bearish and key support levels fails to hold strong.

A wave of whale activity has shaken the Solana [SOL] market recently.

The altcoin’s on-chain data revealed that on the 5th of April, several large holders unstaked and dumped a massive volume of SOL, sparking fears of a deeper price correction.

According to Lookonchain recent tweet, wallet address HUJBzd led the exodus by dumping 258,646 SOL worth approximately $30.3 million.

Following closely, BnwZvG sold 80,000 SOL ($9.47M) while 8rWuQ5 and 2UhUo1 offloaded 30,000 and 25,501 SOL respectively— totaling another $6.53M in sell pressure.

This adds up to a combined $46.3 million worth of SOL dumped within a short window.

Is a deeper correction on the horizon?

Such heavy selling typically hints at bearish sentiment for Solana — especially when the selling pressure is spearheaded by whales.

Given that these sales occurred soon after SOL was unstaked, it suggests a lack of interest in long-term holding, at least for now.

At the time of writing, SOL was already struggling to reclaim the $120 resistance level. With fresh sell-offs adding pressure, there’s a real chance of a retest of the $1oo support zone.

If buyers fail to defend that range, the dip could extend further, possibly toward $98 — a psychological threshold.

Market sentiment leans cautious for SOL

The broader market is not helping, either. With the king coin still volatile, altcoins also seem to follow the suit. As fear creeps back in, retail and institutional investors alike may stay on the sidelines.

This makes any SOL recovery less likely in the short term unless a new catalyst emerges — perhaps from a positive ecosystem development or improved macro trends.

However, it is worth noting that whale activity does not always mean doom for SOL. In past cycles, large dumps have sometimes preceded accumulation phases.

Watching whether these whales re-enter or if fresh wallets pick up the slack will be key for the market participants.

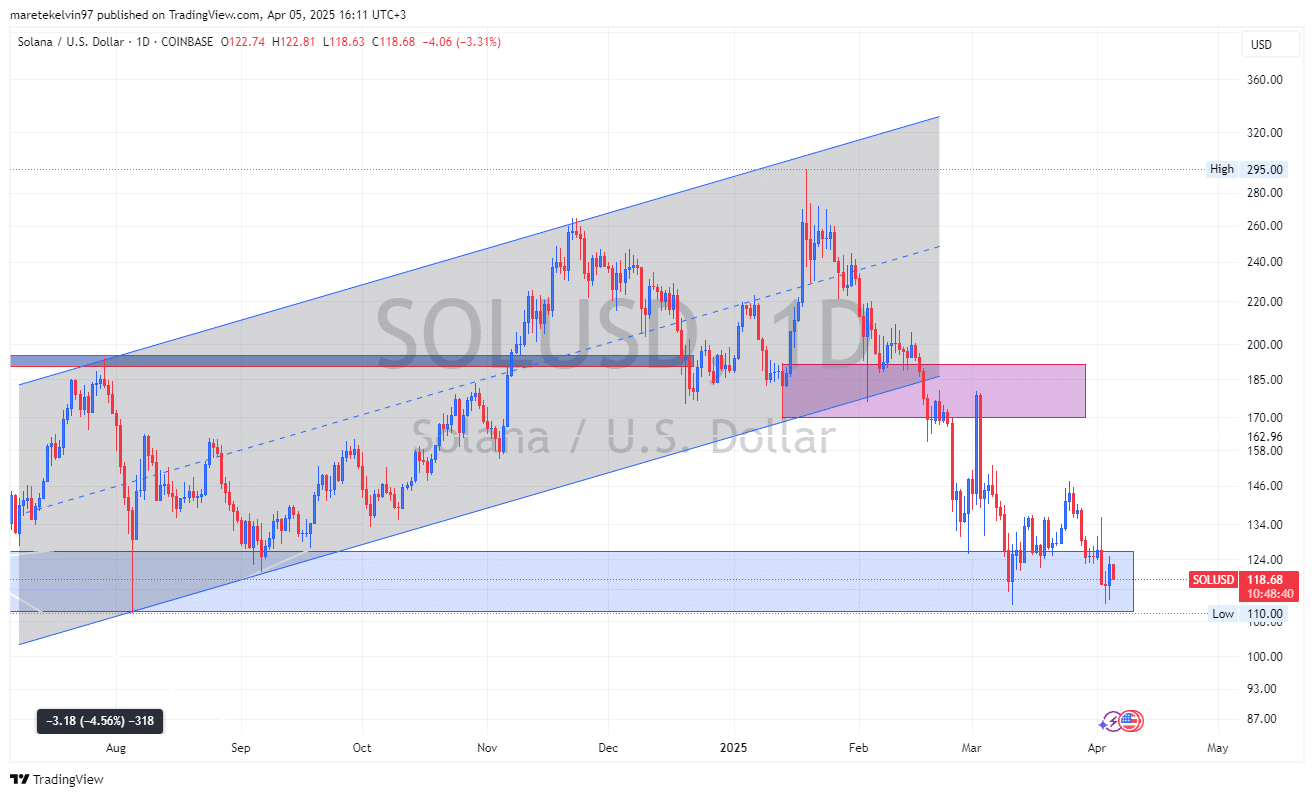

Technically, SOL prices are attempting a likely reversal at a key demand zone. The zone has seen several rejections and has proved to be strong several times.

If this cyclical pattern holds, all is not lost for SOL despite the exodus, and the zone could reject prices to the upside.

For now, traders and investors alike should keep an eye on volume trends and how SOL behaves near the current demand zone at around $110.

A high-volume bounce could signal a short-term reversal, while weak buying might open the doors for Solana to dip further below $100 key psychological price level.

- Multiple Solana whale addresses dumped over $46 million tokens in one day.

- the altcoin could dip further if broader sentiment remains bearish and key support levels fails to hold strong.

A wave of whale activity has shaken the Solana [SOL] market recently.

The altcoin’s on-chain data revealed that on the 5th of April, several large holders unstaked and dumped a massive volume of SOL, sparking fears of a deeper price correction.

According to Lookonchain recent tweet, wallet address HUJBzd led the exodus by dumping 258,646 SOL worth approximately $30.3 million.

Following closely, BnwZvG sold 80,000 SOL ($9.47M) while 8rWuQ5 and 2UhUo1 offloaded 30,000 and 25,501 SOL respectively— totaling another $6.53M in sell pressure.

This adds up to a combined $46.3 million worth of SOL dumped within a short window.

Is a deeper correction on the horizon?

Such heavy selling typically hints at bearish sentiment for Solana — especially when the selling pressure is spearheaded by whales.

Given that these sales occurred soon after SOL was unstaked, it suggests a lack of interest in long-term holding, at least for now.

At the time of writing, SOL was already struggling to reclaim the $120 resistance level. With fresh sell-offs adding pressure, there’s a real chance of a retest of the $1oo support zone.

If buyers fail to defend that range, the dip could extend further, possibly toward $98 — a psychological threshold.

Market sentiment leans cautious for SOL

The broader market is not helping, either. With the king coin still volatile, altcoins also seem to follow the suit. As fear creeps back in, retail and institutional investors alike may stay on the sidelines.

This makes any SOL recovery less likely in the short term unless a new catalyst emerges — perhaps from a positive ecosystem development or improved macro trends.

However, it is worth noting that whale activity does not always mean doom for SOL. In past cycles, large dumps have sometimes preceded accumulation phases.

Watching whether these whales re-enter or if fresh wallets pick up the slack will be key for the market participants.

Technically, SOL prices are attempting a likely reversal at a key demand zone. The zone has seen several rejections and has proved to be strong several times.

If this cyclical pattern holds, all is not lost for SOL despite the exodus, and the zone could reject prices to the upside.

For now, traders and investors alike should keep an eye on volume trends and how SOL behaves near the current demand zone at around $110.

A high-volume bounce could signal a short-term reversal, while weak buying might open the doors for Solana to dip further below $100 key psychological price level.