Hashflow is dominating crypto headlines after its native token, HFT, soared 80% in 24 hours, closing above key resistance levels. Will the HFT DeFi token continue pushing higher on favorable Solana integrations and regulatory tailwinds?

Bitcoin, Ethereum, and some of the best cryptos to buy, including Solana and XRP, were capped yesterday. To put it in numbers, BTC ▼-1.29% failed to follow through and close above $109,000. On the other hand,

ETH ▼-3.31% is still trading below $2,500. At the same time, is trading below $2.5 and, though bullish, has been moving sideways. Meanwhile, is firm but stable, adding less than 2% in the past 24 hours. Even so, it is up nearly 8% in the previous week of trading.

Although top altcoins might appear mostly flat, Hashflow is stealing the limelight following yesterday’s surge. At spot rates, , the native token of the multichain DEX, is up an impressive 80%, topping gains. With this push higher on June 30, HFT is up nearly 190% in the past month and trading within a bullish breakout formation.

Most importantly for HFT, the gains of the past three days have lifted prices above key liquidation levels, setting the base for another potential moonshot to December 2024 highs.

Trading volume is quickly picking up, and though there may have been some profit-taking, as indicated by the long upper wick in the daily chart, the uptrend has been set in motion.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Understanding Hashflow and HFT

Hashflow is a multichain DEX that launched in April 2021. While Uniswap and PancakeSwap may dominate in trading volume, Hashflow offers high interoperability and claims to provide zero slippage, all while shielding traders against maximal extractable value (MEV) bots.

In a field saturated with multiple DEXes, Hashflow stands out using the Request-for-Quote (RFQ) model. In this arrangement, professional market makers manage liquidity in on-chain pools, guaranteeing prices without slippage. Liquidity is further boosted by their use of intent-based Smart Order Routing (SOR), allowing access to most tokens.

The DEX serves some of the top blockchains, including Ethereum, Arbitrum, Avalanche, and the BNB Chain. However, according to DeFiLlama data as of July 1, Hashflow is more dominant on Ethereum and, to some extent, Arbitrum. It manages $620,000 worth of assets, with over $478,000 on Ethereum.

As of July 1, Hashflow claimed to have processed over $25 billion in RFQ volume, all while integrating with more than 30 protocols. Altogether, they have offered more than $500 million in liquidity.

(Source)

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in July 2025

Why is HFT Crypto Rallying?

There are no specific triggers explaining the sharp spike in valuation over the past three days.

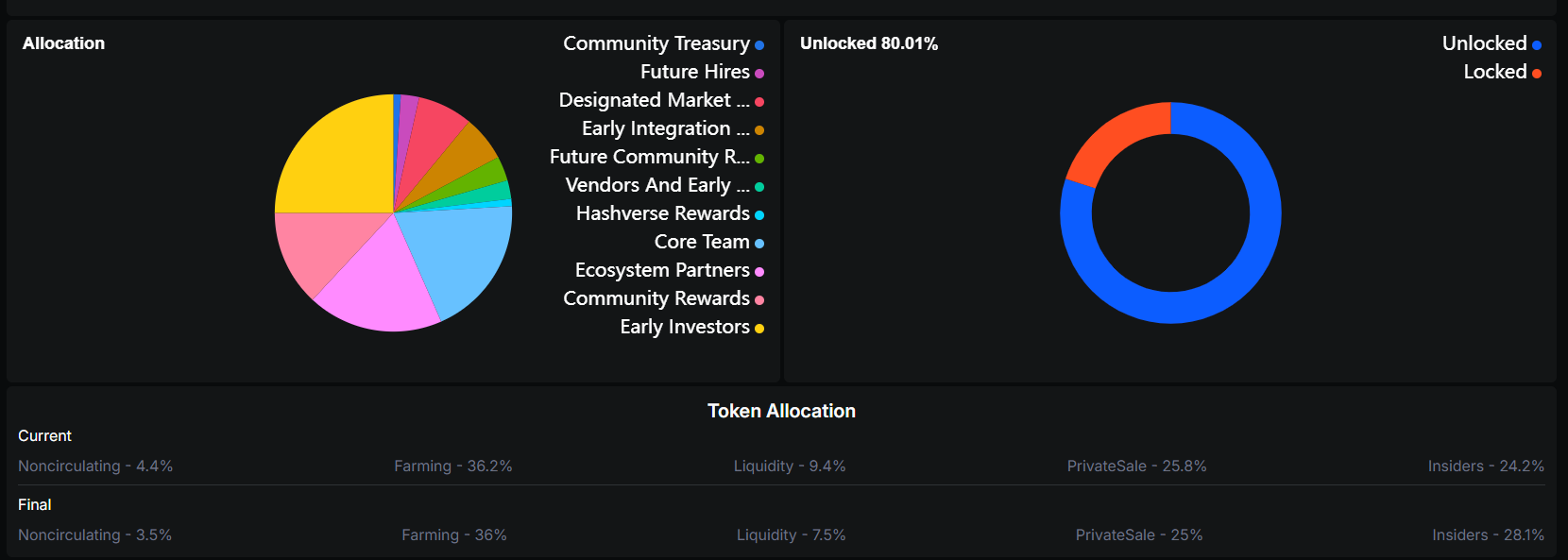

According to DeFiLlama, over 80% of HFT tokens have been unlocked. This means holders shouldn’t expect a supply spike that could slow down growth.

(Source)

Per their vesting schedule, 9.7 million HFT will be unlocked on July 7 and once every month thereafter until November 2026.

Hashflow has also deepened its integrations within the Solana ecosystem. The DEX has partnered with some of the top players in the expansive Solana ecosystem, joining hands with Jupiter, Kamino, and Titan. With this expansion, their cross-chain trading efficiency has increased, attracting more users and, thus, liquidity.

Overall, Solana has a thriving ecosystem and anchors meme coin trading. If there is a boom in meme coin activity, as seen in 2024, Hashflow could offer a route for efficient and low-fee trading of some of the top Solana meme coins. Because of the last meme coin boom in Solana, Raydium (RAY) soared thanks to Pump.fun activity.

Hashflow is growing fast in the Solana ecosystem

Binance now supports $HFT on Solana and so do we.

We’ve already integrated with Jupiter, Kamino, and Titan. More integrations are coming.

Where should we deploy next? Drop your picks

— hashflow (@hashflow) June 30, 2025

Additionally, Hashflow is riding on the Binance brand. It is a Launchpool project, and by default, HFT is listed on the world’s largest exchange, benefiting from high visibility. This exposure means investors can easily buy HFT, a move that has been pivotal in amplifying its market presence.

In the days ahead, Hashflow, together with other DeFi tokens, could benefit immensely from regulatory tailwinds in the United States. With the GENIUS Act passed in the Senate, experts expect more DeFi innovation thanks to reduced compliance burdens.

This is a massive boost for Hashflow, paving the way for institutions to get involved. Paul Atkins, the SEC chairman, has already said DeFi helps promote financial inclusion and innovation.

Key points from Chairman Paul Atkins’ remarks today at “DeFi and the American Spirit,” SEC’s Crypto Task Force Roundtable on Decentralized Finance – a

— U.S. Securities and Exchange Commission (@SECGov) June 9, 2025

The regulator’s stance has changed, unlike in the previous administration, which means HFT is not at risk of being listed as an unregistered security.

DISCOVER: Best New Cryptocurrencies to Invest in 2025 – Top New Crypto Coins

Hashflow Crypto Dominant, HFT DeFi Token Up 80% In 24 Hours

- HFT crypto dominant, up 80% in 24 hours

- Hashflow DEX is a Binance launchpool project

- DEX expands integration in Solana

- Regulatory tailwinds, including GENIUS Act and SEC’s DeFi support, could push HFT crypto higher

The post What is Hashflow Crypto? Why is the HFT DeFi Token Rallying? appeared first on 99Bitcoins.